Forex EBooks

Topic outline

-

Table of Contents

- Pips, Spreads, Base/Quote Currency, and Lots

- Bulls and Bears: The Wild Side of Forex

- Leverage and Margin: The Double-Edged Sword

- Midnight Swaps: Overnight Costs or Gains?

- Conclusion

Introduction

Hey there, future forex trader! Are you tired of feeling like a lost sailor in the vast ocean of forex trading? Well, worry no more! This handy e-book is here to help you easily navigate the treacherous waters of forex jargon. We’ll strip away the complex terminology and explain the most essential concepts in a way that even your grandma would understand. So please grab a cup of coffee, put on your learning cap, and let’s dive right in!

Chapter 1: Pips, Spreads, Base/Quote Currency, and Lots

In this chapter, we’ll demystify the terms that make up the foundation of forex trading. You’ll learn what pips are, how to calculate them, and why they matter. We’ll also explore spreads, those sneaky little creatures that affect your profits. Lastly, we’ll shed light on lots and explain why they determine the size of your trades.

Pip

In foreign exchange terminology, a pip is an acronym for “point interest point”, “percentage in point” or “point in price.”

It is a unit to measure the changes in the value of a currency pair. For example, if the EURUSD currency pair moves from:

then it has moved 1 pip.

Similarly, if the GBPUSD currency pair has moved from:

then it moved 3 pips.

As you might have guessed, the pip corresponds to the fourth decimal digit in an exchange rate:

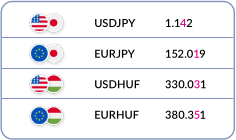

Of course, for every rule, there is an exception, and this is the case of the currency pairs involving the Japanese Yen (JPY) or the Hungarian Forint (HUF), where the pip corresponds to the second decimal digit:

For example, if the exchange rate of the USDJPY has moved from:

then it moved 4 pips.

Point

This is the smallest unit of price movement in an exchange rate.

When it comes to most currency pairs, the point corresponds to the fifth digit after the decimal.

As you might have guessed already, for currency pairs that involve the Japanese Yen (JPY) or the Hungarian Forint (HUF), the point corresponds to the third decimal digit:

I am sure you got the point!

Bid & Ask Price

Currency pairs are quoted in two prices, bid and ask.

The bid refers to the price that a seller is willing to sell a currency pair. On the other hand, the ask price refers to the price a buyer is willing to accept to buy a currency pair at.

Now, that’s easy!

Spread

Forex spread is the difference between the buying and selling price of a currency pair, representing the fee charged by brokers for executing trades.

Now, let’s say you want to buy the EURUSD currency pair. The broker might offer you a buying price of 1.2000, but if you want to sell it right away, they’ll give you a selling price of, let’s say, 1.1998. That’s the spread right there! In this case, the spread is 2 pips, which is the difference between those two prices.

So, in forex terminology: Spread = Ask Price - Bid Price

Base & Quote Currencies

Currencies are always traded in pairs because you’re comparing the value of one currency against another. Each currency pair consists of a base currency and a quote currency.

It is a unit to measure the changes in the value of a currency pair. For example, if the EURUSD currency pair moves from:

The base currency is the first currency listed in the currency pair, and it’s like the main character of the pair. It represents the currency you’re buying or selling. For example, in the EURUSD pair, the euro (EUR) is the base currency. So, if you’re buying the EURUSD pair, you’re buying euros using U.S. dollars.

On the other hand, the quote currency is the second currency in the pair. It’s like the supporting actor, providing the value against which the base currency is measured. In the EURUSD pair, the U.S. dollar (USD) is the quote currency. So, when you see the exchange rate

for the pair, it shows you how many units of the quote currency (USD) are needed to buy one unit of the base currency (EUR).To make it simpler, think of the base currency as the item you want to buy and the quote currency as the price you’re paying for it.

Remember, the value of a currency pair represents the amount of the quote currency required to buy one unit of the base currency. If the exchange rate for the EURUSD pair is 1.2000, it means that you need 1.2000 U.S. dollars to buy one euro.

Now that you’ve got the base and quote currencies down, it’s time to move on to decipher another forex term, but before we do that, keep in mind that the terms “quote currency” and “counter currency” are often used interchangeably. They actually refer to the same concept in the context of forex trading.

Lots

Imagine you’re at an ice cream shop, faced with the tough decision of choosing how much ice cream you want. Now, in forex, lots work kind of like that. They determine the size of your trades, just as you decide how big of a scoop of ice cream you want.

In forex, a lot refers to a standardized unit of currency. It’s like a pre-determined amount that you trade with. There are three main types of lots:

Standard Lots

A standard lot is the largest size in forex trading. It represents 100,000 units of the base currency in a pair. For example, if you’re trading the EURUSD pair, a standard lot would be 100,000 euros.

Mini Lots

As the name suggests, mini lots are smaller than standard lots. A mini lot represents 10,000 units of the base currency. So, if you’re trading a mini lot of the EURUSD pair, it would be 10,000 euros.

Micro Lots

Micro lots are even smaller than mini lots. They represent 1,000 units of the base currency. So, if you’re trading a micro lot of the EURUSD pair, it would be 1,000 euros.

Why do we have different lot sizes?

Well, it all comes down to flexibility and risk management. Different traders have different account sizes and risk tolerances. Some may prefer to trade with larger positions using standard lots, while others may opt for smaller positions using mini or micro lots.

Chapter 2: Bulls and Bears: The Wild Side of Forex

Get ready to enter the animal kingdom of forex trading! In this chapter, we’ll introduce you to the mighty bulls and fierce bears. You’ll discover what it means when the market is bullish or bearish and how these trends can make or break your trading strategies. We’ll also discuss the terms “long” and “short” and why they are essential in navigating the forex wilderness.

The terms "bulls" and "bears" are commonly used in the financial world to describe the behavior and sentiment of market participants. These terms originate from the traditional way in which these animals attack their opponents.

The term “bull” is used to describe buyers or investors who have a positive outlook on the market or a specific asset. Bulls believe that prices will rise, and they act accordingly by buying stocks, commodities, or other assets with the expectation of profiting from their price

appreciation. The term “bull” represents strength and upward movement, as a bull thrusts its horns upward when attacking. Similarly, a bullish trader would enter a long position to benefit from the rally.For example, say that a bullish trader places a buy (long) order of EURUSD at 1.1800 and then closes the position after the rally at 1.1950. Therefore, they made a profit of 150 pips!

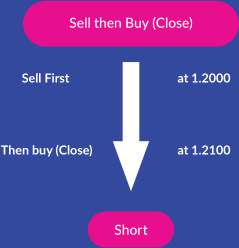

On the other hand, the term "bear" is used to describe sellers or investors who have a negative outlook on the market or a specific asset. Bears believe that prices will fall, and they act accordingly by selling stocks, commodities, or other assets with the expectation of profiting from their declining prices. The term “bear” represents a downward movement, as a bear swipes its paws downward when attacking.

Similarly, a bearish trader would enter a short position to benefit from the decline.

Note that in forex, selling refers to the act of selling a currency that you already own. In fact, you get rid of the currency pair in exchange for cash.

Conversely, short selling refers to selling a currency pair you do not currently own.

In a short sale, a trader “borrows” the asset from a broker, sells it on the market, and then aims to buy it back at a later time and return it to the lender. The goal of short selling is to profit from a decline in the price of the asset. For example, say that a bearish trader places a short order of EURUSD at 1.2100 and then closes the position after it had declined at 1.2000. Hence, they made a profit of 100 pips!

Chapter 3: Leverage and Margin: The Double-Edged Sword

Leverage and margin are like the superheroes and villains of forex trading. They have the power to multiply your gains, but if not handled carefully, they can also magnify your losses. We’ll explain how leverage works, why it can be a game-changer, and the risks involved. You’ll also learn about margin, the collateral you need to open trades, and the dreaded margin call.

Leverage

Leverage is a financial tool that allows traders to control larger positions in the market with a smaller amount of capital. It enables traders to amplify potential profits, but it also increases the risk exposure.

When you open a forex trading position with leverage, you are essentially “borrowing” funds from your broker to increase your trading power. The leverage ratio determines how much capital you can control compared to your own invested funds. For example, if your broker offers a leverage ratio of 1:1000, it means that for every $1 of your own capital, you can control a trading position worth $1000.

Own Capital Leverage Ratio Trading Capital 1000 1:10 10 000 1000 1:100 100 000 1000 1:500 500 000 1000 1:1000 1 000 000 Say you have $1,000 in your trading account, and you want to trade with a leverage ratio of 1:100. With this leverage, you can control a position worth $100,000 ($1,000 x 100). The remaining $999,000 is provided by the broker as borrowed funds.

Now, if the value of the currency pair you’re trading moves in your favor by 1%, you would make a profit of $100,000 x 1% = $1,000.

Congratulations, you doubled your account!

However, it’s important to note that leverage magnifies both profits and losses. If the value of the currency pair moves against you by 1%, you will also incur a loss of $1,000.

I am sorry. You just lost your account!

It’s crucial to exercise caution when using leverage in forex trading. While it can enhance potential gains, it also exposes traders to greater risks. So, use leverage sensibly.

Margin

Now, the cool thing about Margin is that it allows you to control a larger position than what your actual account balance might allow. It’s like trading with borrowed funds. So if you have, let’s say, $1,000 in your account, and your broker offers you a 1:100 leverage, you can control a position worth $100,000. Pretty neat, huh? It sounds like leverage! But what is the required Margin?

Well, here is the formula: Margin = Size of trade / Leverage

Suppose you deposit €1000 in your account using leverage of 1:100. I am sure it’s clear by now that you can control €100 000! Amazing, isn’t it?

So, you decide to buy 1 lot (i.e., 100 000) EURUSD. Since you don’t have enough own funds in your account, you will be trading on Margin. No worries. Just make sure that you set aside (don’t panic, it’s done automatically by the trading platform) the Margin required.

How much is that again?

Margin = €100 000 / 100 = €1000

Not that difficult after all!

This is an easy one! Your account Balance refers to the amount of funds you initially deposited plus any profits or losses of any closed trades. As simple as that.

For example, suppose you make an initial deposit of $1000. What is your Balance?

If you said $1000 then you are absolutely right. Now, after closing a winning trade you made a profit of $100.

What is your Balance again? $1000 + $100 = $1100

That’s right.One more example before I let you go.

Suppose now that after the profitable trade of $100 you decide to enter the market again and you suffer at the moment a floating loss of $50.

What is your Balance?

Well, $1000 + $100 = $1100

The floating loss of $50 is not taken into account when calculating the Balance because the word floating refers to an open trade!

Remember, Balance is the amount of funds in your account when there no open positions.

Equity

On the other hand, Equity refers to the amount of funds in your account plus/minus any profit and loss of open positions. It’s basically the combination of your account balance and the unrealized profits or losses from your open trades.

For the sake of completeness, the formula for calculating the Equity is:

Equity = Balance ± Profit/Loss + Credit ± Swaps – Commission

Account equity is significant because it’s used to determine your Margin and available trading capital.

Free Margin

Now that we understand Equity, let’s move on to Free Margin.

Every time you open a position, part of your Equity is reserved as Margin to maintain that open position. It’s like collateral.

In forex, Free Margin is the amount of cash you have available in your trading account to open new trades. It’s the cash you can use to get in on the action and take advantage of exciting market opportunities.

Here’s how it works: You start with your account balance, which is the total amount of money you have in your account. Now, let’s say you already have some trades open, and they’re using up a portion of your account balance as collateral (that’s the Margin we talked about earlier).

Free Margin comes into play because it tells you how much of your account balance is still available for new trades.

Simply put: Free Margin = Equity – Margin (used for open positions)

For example, say that after depositing $1000 in your trading account with a leverage of 1:1000, your trading capital is increased to $1 000 000, and you decide to buy 1 lot of EURUSD, where you suffer a loss of $500. Sorry about that.

Subsequently, you enter the market again with two lots of EURUSD.

Free Margin = Equity – Margin (used in open positions)

= ($1000 - $500) – ($200 000 / 1000)

= $500 - $200

=$500 - $200

=$300Nobody likes losing money, right? That’s why we delve into the world of risk management in other eBooks. You’ll discover the importance of setting stop loss and profit levels to protect your trades. We’ll also discuss risk-reward ratios and position sizing, empowering you to manage your risk like a pro. With these tools in your arsenal, you’ll sleep better at night, knowing your trading risks are under control.

Margin Level

Brokers typically have their margin level requirements, but in general, anything above 100% it’s considered “fit” or “healthy”. It is essential for traders to monitor their margin level regularly to ensure sufficient Margin is available to support their open positions and to avoid unwanted liquidations. You see, the margin level serves as an indicator of the trader’s account health and risk exposure. A higher margin level indicates a healthier account with lower risk, while a lower margin level suggests a higher risk of a potential margin call or stopout (when trades are automatically closed to prevent further losses).

The margin level is calculated by dividing the Equity in the trading account by the Margin used and multiplying the result by 100 to get the percentage.

Margin Level = (Equity / Used Margin) × 100

Here’s a breakdown of the terms used in the formula to refresh your memory:

Equity: Equity represents the current value of the trading account. It is the sum of the account balance and the unrealized profits or losses from open positions.

Used Margin: Used Margin refers to the amount of Margin that has been utilized to maintain open positions. It is the portion of the account balance that is currently locked as collateral.

Margin Call

In the unpleasant situation where the account’s Equity falls below the required margin level (i.e.100%), the trader is required by their broker to deposit additional funds in their trading account.

Let’s walk through an example to comprehend the new concept of the margin call.

Say, you deposit $1000 in your trading account, choosing a leverage of 1:500. Obviously, your trading potential is multiplied by 500, and now you control $500 000. Hence, you can open positions up to $500 000. Cool, right?

So, off you go, and you decide to buy 2 lots of USDJPY at 150.000 as you believe that it will rally.

Since you are trading with more than what you deposited, it makes perfect sense that the broker requires that you keep an amount of money in your account at all times. This amount is called the Margin required.

Margin Required = Size of Trade / Leverage

= 200 000 / 500

= $400Unfortunately, after some time, the market declines in the opposite direction incurring a floating loss of $700! Sorry about that.

Recalling the definition of Margin Level = Equity / Margin Used x 100

Balance floating loss

Margin Level = (1000 – 700) / 400 * 100 = 75%

I am sure that you will agree with me that your account is not very “fit” after all as its Margin Level is below 100%.

Right? I hope it’s clear.

Now what? Now, you either deposit more money in your account or start closing any losing positions to free up Margin.

Scenario 1

Let’s go ahead and close 1 lot of the USDJPY position.

Recalculating the Margin Level = Equity / Margin Used x 100

= (1000 – 700) / 200 x 100

= 300 / 200 x 100

= 150%Well, this will do!

Scenario 2

Instead of closing part of the trade, let’s go ahead and deposit an additional $500.

Margin Level = Equity / Margin Used x 100

= (1000 + 500 – 700) / 400 x 100

= 800 / 400 x 100

= 200%Awesome!

Margin calls are designed to protect both the trader and the broker. They help ensure traders have sufficient funds to cover potential losses and prevent the account balance from going into negative territory. It’s important to monitor your trades, manage your risk, and maintain a healthy margin level to avoid margin calls.

Chapter 4: Midnight Swaps: Overnight Costs or Gains?

Welcome to forex swaps! In this chapter, we’ll delve into the misunderstood concept of forex swaps, shedding light on this concept of currency trading. If you’ve ever wondered what happens to your trades overnight or why certain positions incur additional costs or gains, then you’re in the right place. You will learn the basics of forex swaps and how they are calculated. And if that wasn’t enough, wait until you understand the mighty triple swaps!

Swaps

Swaps are like little fees that you either pay or receive for keeping your position open overnight. It’s kind of like rent you pay for borrowing money to trade. The swap rate depends on the interest rate differential between the two currencies you’re trading. Suppose you’re buying a currency with a higher interest rate and selling a currency with a lower interest rate. In that case, you’ll usually receive a small amount of money as a swap payment. On the other hand, if you’re doing the opposite, you may have to pay a swap fee. Of course, brokers may apply additional fees or markups depending on the market conditions.

There is Swap Long for buying a currency pair and Swap Short for selling a currency pair.

Swaps are not fixed, but rather they vary from currency pair to currency pair. They are expressed in pips per lot and are part of each pair’s specifications.

For example, say that the Swap Long for EURUSD is -0.662 and the Swap Short is 0.361.

If you buy 1 lot EURUSD on Tuesday and close it on Wednesday, then Swap Long will be applied for 1 night:

100 000 x (-0.0000662) x 1 =- 6.62 x 1 = -$6.62

Your account will be charged $6.62 for keeping the position open overnight.

Oops!Not all swaps are negative! If you decide to short the EURUSD on Monday and then close it on Wednesday, Swap Short will be applied for 2 nights:

100 000 x (0.0000361) x 2 = 3.61 x 2 = $7.22

Your account will earn $7.22

Thank you, Mr Swap!

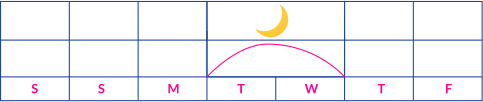

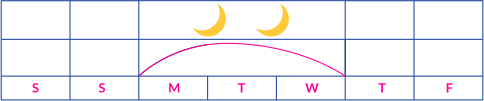

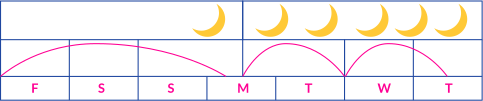

Triple Swaps

Now, let’s talk about triple swaps. They are basically swaps on steroids! Triple swaps come into play when you keep your position open over the weekend. Since the forex market is closed on weekends, brokers usually apply triple swaps on Wednesdays (i.e., midnight) to account for the days the market is closed. It’s like a way for them to say, “Hey, you’re holding this position for an extended period, so we’ll adjust the swaps accordingly.”

Let’s say you short (sell) 1 lot EURUSD on Friday, and then you decide to close it on Thursday.

As you might suspect, if you keep a position open over Wednesday night, then the 3-day Swap will apply.

100 000 x 0.0000361 x 6 = $21.66

You just earned $21.66 Keep up the good work!

Remember, swaps and triple swaps are part of the forex trading business. So, it’s essential to understand how they work and consider them in your trading strategy. Happy trading, and may the swaps be in your favor!

Congratulations, dear reader!

You’ve successfully journeyed through the mysterious land of forex jargon. Armed with this newfound knowledge, you’re ready to conquer the forex markets and make your mark as a savvy trader. Remember, forex trading is a continuous learning process, so keep honing

your skills and exploring new strategies. But above all, have fun and enjoy the excitement forex trading brings.Happy Trading!